Understanding the risk profile of a startup is important. You can't win if you don't know what game you are playing. Investing in or building a new Startup is essentially a bet; good betting is all about risk. I identified risk profiles that helped me understand better what type of bet I'm making and what is the key to making them successful.

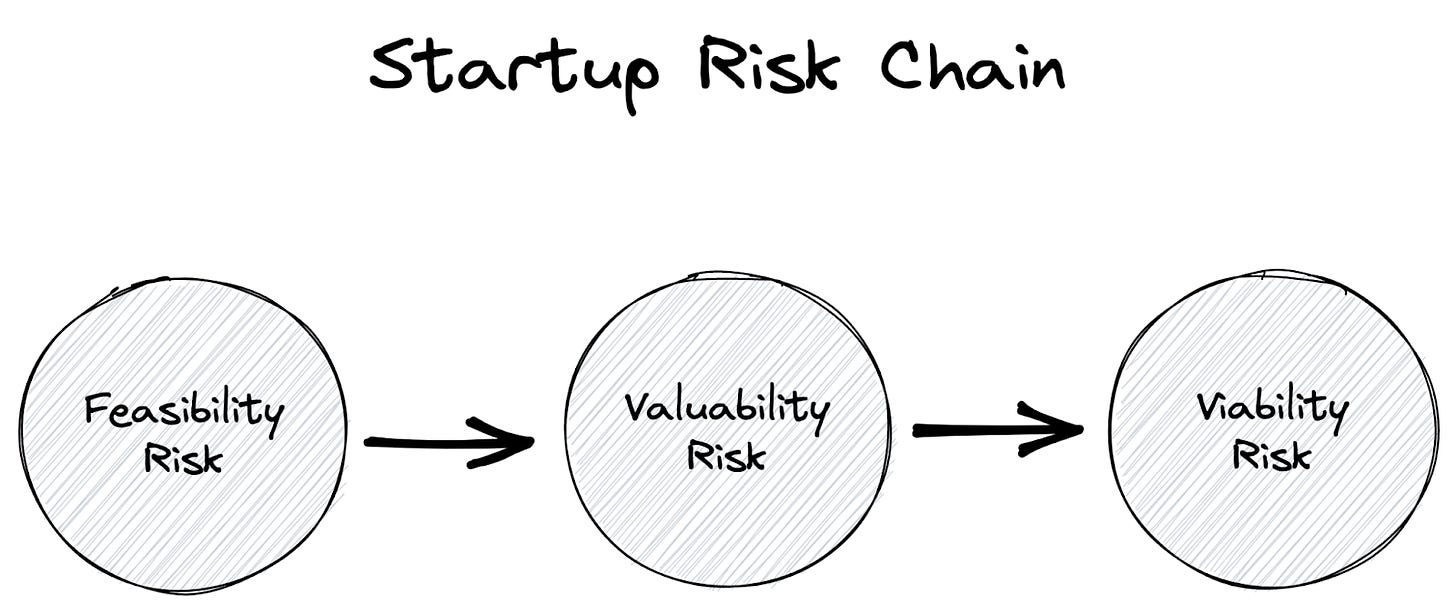

Before we get into the risk profiles, we need to talk about the main types of risks in a Startup: Feasibility Risk, Valuability Risk, and Viability Risk.

The three types of risk have a dependency relationship that you can see in this chain:

Link 1: Feasibility. If your product is not feasible, it doesn't matter if users would love it or if you can make money. If you can't build it, you will fail. This is why the first step is always to check for feasibility. You prove feasibility by building your product. However, having a feasible product is not enough.

Link 2: Valuability. If you know your product is feasible, then you must know if it's valuable to your users. In this step, you must find Product/Market fit. This step is by far the one that kills most startups. Most startups never find Product/Market fit. Even if you create a valuable product, you can still fail at building a business.

Link 3: Viability. You built the product, and your users love it. However, you need to figure out how to generate value for the business. This step is not always obvious. A great example of this is Google. It took a while until they figured out their business model. The implementation of the ad space auctioning model is a great feat in itself. It was the innovation in the business model as well as a great product that led google to victory.

The chain of dependency doesn't mean you need to work in any particular order. Nothing impedes starting to work in any link first or even working them in parallel. The main purpose of the model is to point out that later links in the chain are useless without the previous links.

Risk Profiles of AI Startups

We can combine these three risk types into distinct profiles. What people are calling “AI Startups” are in reality two extremely distinct groups: Shallow AI and Deep AI. They can be understood better by looking at their risk profiles:

Shallow AI Startup

I call Startups building new products using existing models "Shallow AI". These companies are not investing massive amounts of money in R&D to train their own models or create specialized hardware. They are using APIs provided by other players in the AI ecosystem.

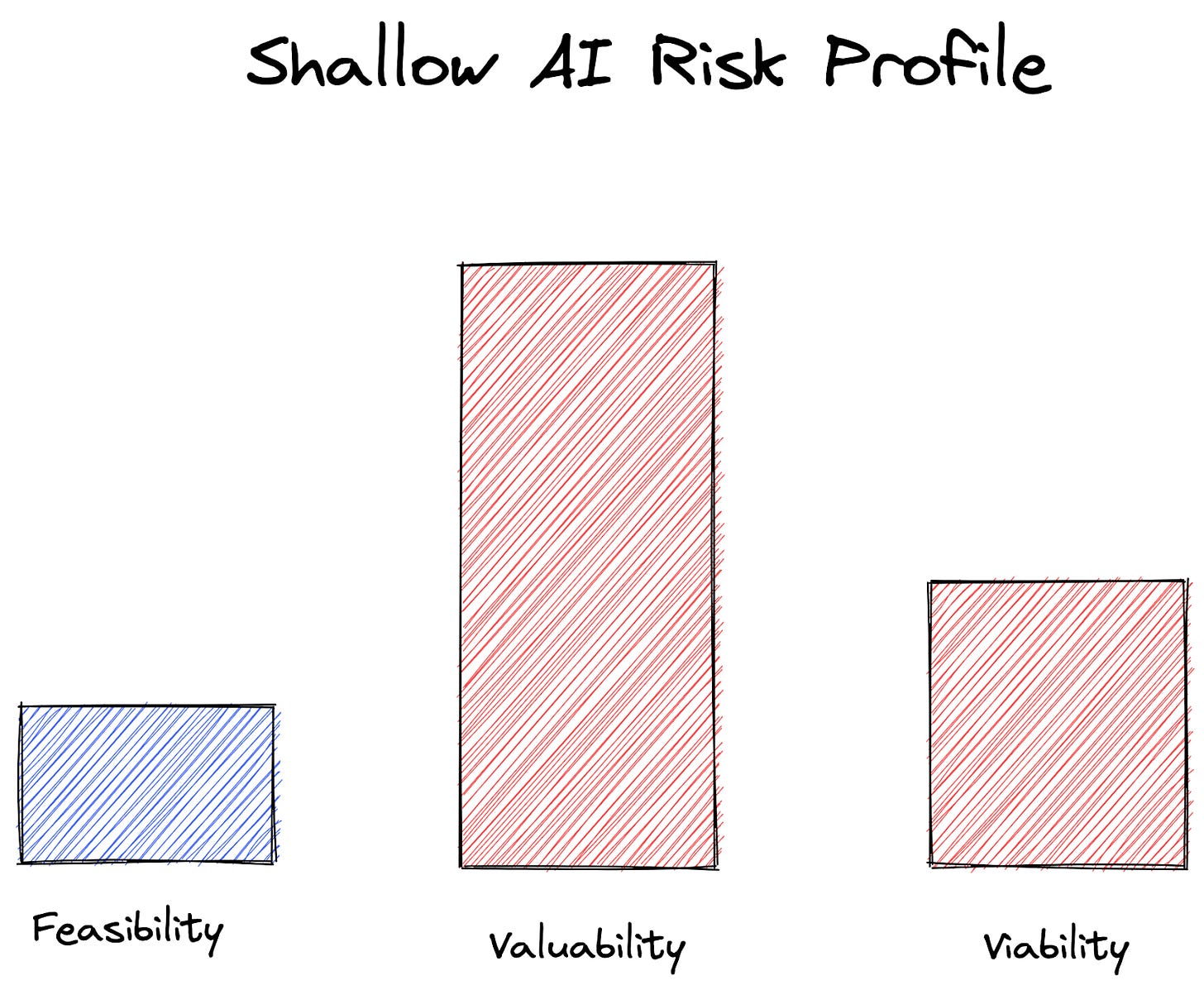

Those startups are more similar to traditional Web 2.0 (see appendix) and Mobile companies. The pivotal risk for these companies is the Valuability Risk. It's alluring to build something using AI with all the hype and new possibilities, but this will lead to many products that are just gimmicks. Delivering real value to users will be the main challenge in this space.

Shallow AI companies have more feasibility risk compared to Web/Mobile apps. This happens because even though many models are available, there is no guarantee that you will get the quality output you want. A lot of thinking is still necessary to get a good end result.

Here is how I see the shallow AI startup risk profile:

Deep AI Startup

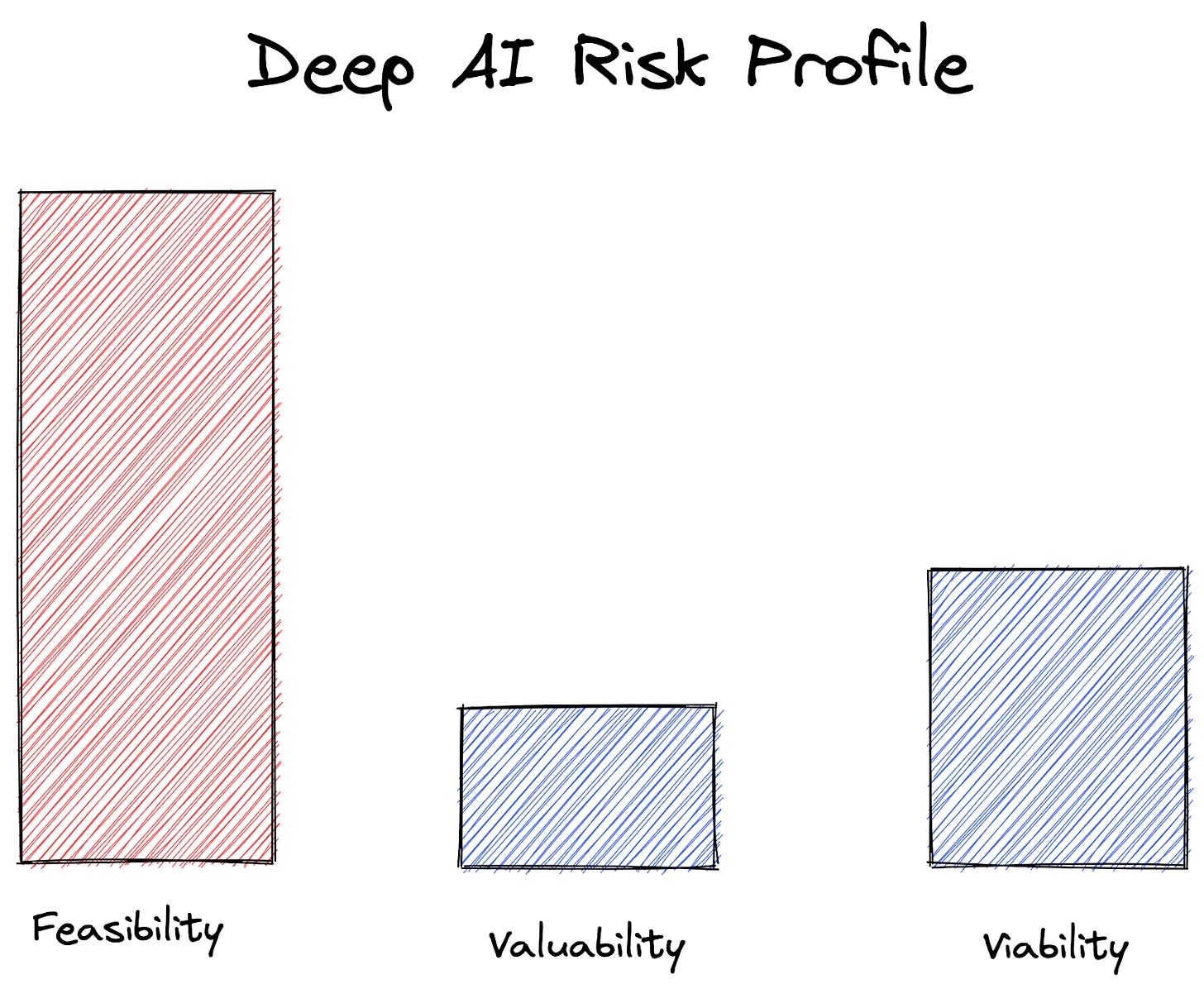

Deep AI startups are developing new technology instead of using existing ones. There are two big groups of Deep AI startups. One is building new foundational models; we can think of companies like OpenAI and Anthropic as part of this group. The other group is building new hardware for AI; a good example is Cerebras.

The feasibility risk is the dominant risk factor in these companies. It's hard to predict if success in research endeavors. For a while, even the valuability and viability risks were high. When companies like Deep Mind and OpenAI started, the risk was so high that it all seemed like a crazy idea.

With AI showing progress towards delivering more and more value, the risk profile of a Deep AI Startup looks something like this:

Two quite distinct types of startups are being lumped together as AI startups. Deep AI startups focus on research and Shallow AI companies in product and GTM. It is essential to understand this distinction if you want to invest or start your own company. Knowing what game you are playing is the first step to winning it.

Appendix

We can also classify other waves of startups by their risk profiles:

Web 2.0

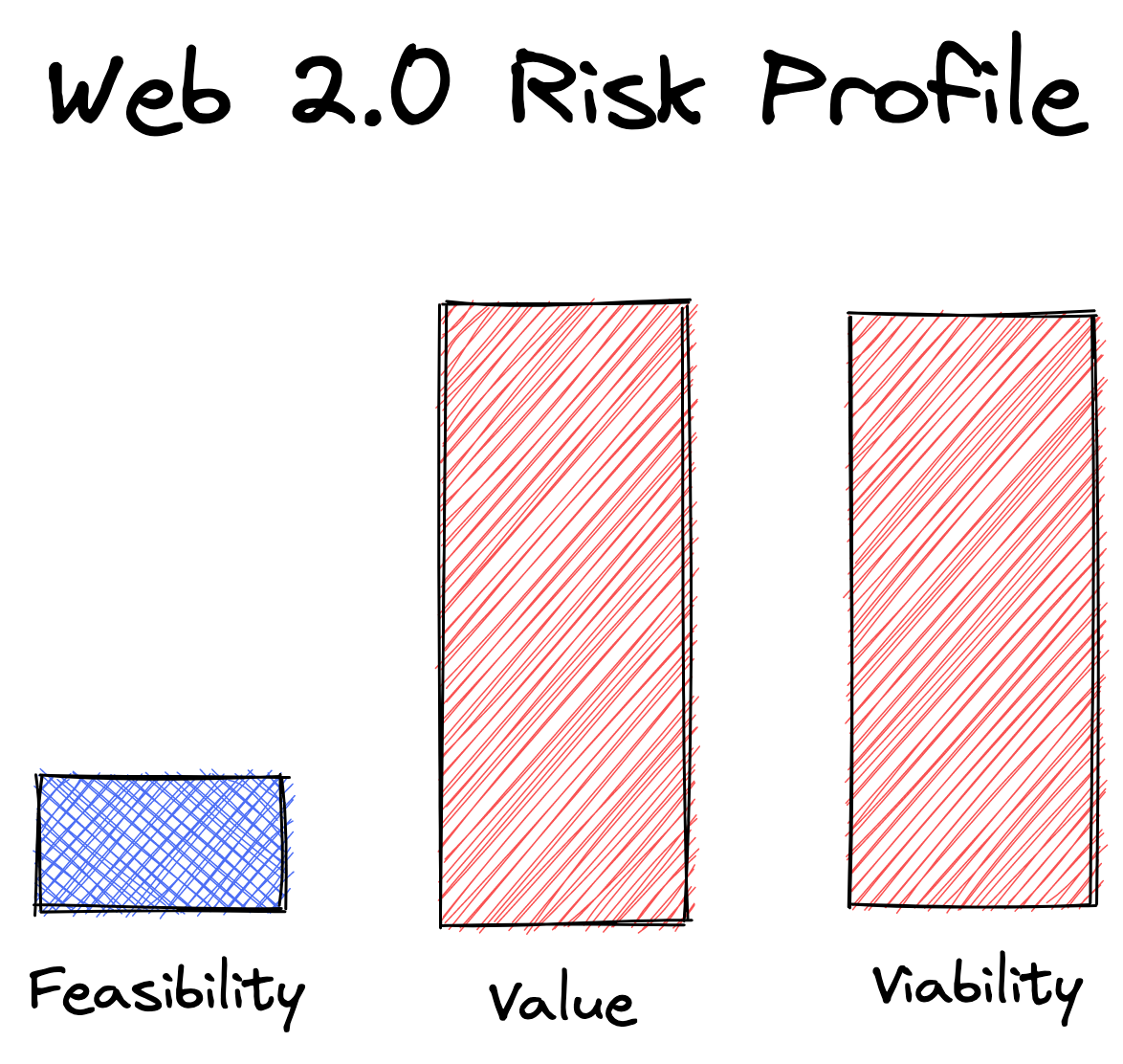

The big wave of new startups that took advantage of the widespread use of the internet was called Web 2.0. The key here was the migration from desktop-centric to web-centric software. Companies like Google and Facebook are good examples of Web 2.0 startups.

The Risk profile of Web 2.0 companies looks like this:

The two major risks in this scenario are the Value and Viability risks. The feasibility risk is low or almost nonexistent. Mark Zuckerberg was able to code the first version of Facebook from his dorm at Harvard. Any moderately competent hacker would be able to do it too. The risk was never not being able to build Facebook. The risk was nobody using it. The viability risk was also high. Even if people used Facebook, it was not clear if a real viable business could be built around it. The lack of a business model was the most common criticism of Web 2.0. It was not uncommon to call Web 2.0 startups "not real businesses." It turns out that many of them were actually not real businesses in the end, but the ones that won, won big.

Web 3.0

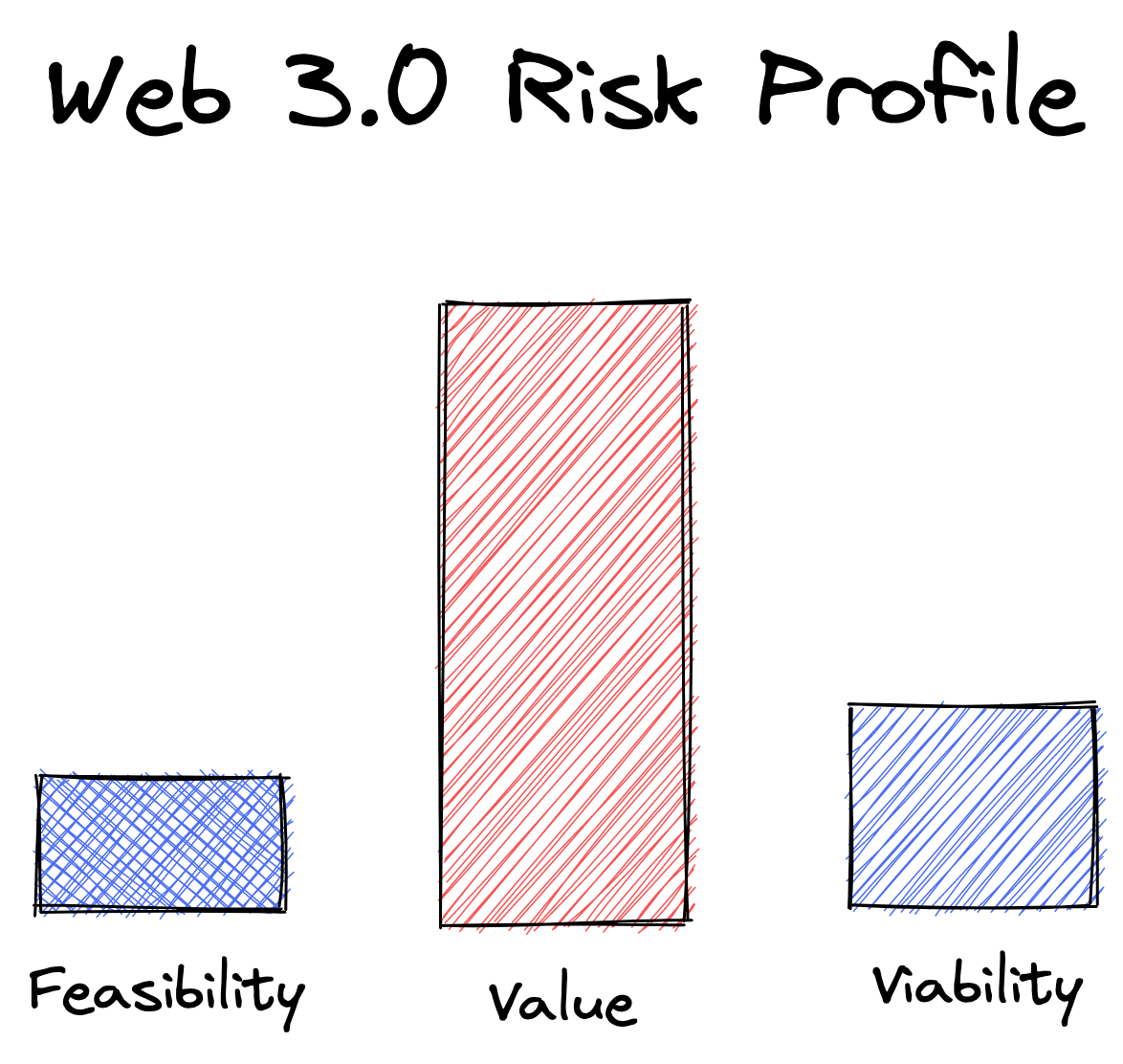

The wave of Web 3.0 startups grew from the excitement around blockchain-related projects like Bitcoin and Ethereum. The so-called "Crypto" or "Web 3" startups have a different risk profile from Web 2.0 era:

The value risk remains high for those projects. However, the viability risk is lower. The tokenization and financialization of the Web 3 services allow for a clear way to make money if the project is successful. This could seem like an improvement over Web 2.0, but it's not that simple.

As discussed before, the 3 risks work like a chain, by skipping one you still have the dependency from the previous links in the chain. People were used to seeing Web 2.0 companies tackling viability risk after solving for value risk, this can create the illusion that crypto companies had value risk figured out because they were doing well on the viability side of the chain.

Deep Tech

Deep Tech startups are startups bringing new technology to the market. Their major risk is the feasibility risk. Deep Tech startups take risks in building something that they are not 100% sure is possible. Building a reusable rocket, Gene Therapies, Fusion Reactors, AGI, you get the idea. The risk profile of Deep Tech startups can be seen as follows:

Feasibility Risk is the dominant factor here. This is the big differentiator between Deep Tech and Shallow tech startups. In order to make sense to take on feasibility risk the other risks should be lower. It's possible to have a Deep Tech Startup with both High Feasibility risk plus another one with high risk but it would be extremely hard to raise capital for such a company. If you are taking on a feasibility risk it is expected that you compensate by lowering the other two risks.

Understanding startup risk profiles will give you a better understanding of what kind of bet you are making while investing or building a startup. It also gives you a good intuition as to where you should prioritize your efforts. Because by understanding what are the key risk factors you can make a plan to work your way up the chain of risks toward success.

Thanks for sharing this structure, this is really helping me to structure the things better in my mind model now.

I have the ambition to go to deep tech, where feasibility reigns, but I expect/hope that in the end I could win big like some did with Web 2.0. Let's see :)

P.S. 1: I somewhat disagree a little bit with the Web 3.0 chart, maybe this is the one I think it's more equilibrate for now, but I agree that value is the most important thing indeed, and I got what you mean :)

P.S. 2: Thanks for sharing this content with us!

Excellent analysis... it makes total sense and organizes a lot the way I unconsciously thought about it. Thanks!